Cathy's Story

When I married James* in 1978, I was 21 years old. I never could have imagined then that I’d be a widow by 26, or that I’d have a 9-month-old baby to take care of on my own. As soon as we became pregnant, James started talking about Insurance, but I was hesitant. I was 24, but James was already thinking like an adult. It’s not that I wasn’t an adult; the topic of life insurance was just scary. I was pregnant with our yet-to-be-born child, and the last thing I wanted to think about was one of us dying. James passed away on a Tuesday in March. The weekend before, we’d had an especially good time together. That Monday evening, my neighbor came over to watch a show. James sat with us but left early and was already asleep when I joined him later. The next morning, he left for work without me seeing him. Whether he kissed me goodbye while I slept, I’ll never know. I had a hair appointment with the woman across the street. I was sitting in a chair in her basement when I heard footsteps coming down the stairs. I turned to see my brother, Paul, who, like James, was a construction worker. He looked at me and said, “Cathy, we have to go.” I remember him pulling me out of the chair, and driving to the hospital. My first words were, “How bad?” He just squeezed my hand.

When we arrived at the ER, the other construction workers were there. It was hard for them to look at me—and that’s when I knew. My story is a reminder that once you have a family—no matter your age—life insurance is absolutely essential. I didn’t want to think about that at the time, but lucky for me, my husband had. James had been in an accident on the construction site. Winds were 50 mph-plus that day, and a wall he was working on had collapsed. To avoid being hit, James had jumped off the wall and landed on his back. When the wall fell, a piece of cinder block hit him in the chest, cracking a rib and severing his aorta. The coroner said that he died instantly.

When you're the widowed mother of a 9-month-old baby, life becomes hazy. Since James died on the job, I was able to receive workman’s comp until I remarried (Leslie was entitled to the payments until she was 18), as well as social security payments for both me and Leslie. The combination of workman’s comp, social security and life insurance gave me options, like being able to work part-time instead of full-time at the type of jobs best suited for a single parent. As a nurse, I’d worked days and nights--sometimes 12 hours at a time. The money that we received allowed me to work part-time instead of full-time, and I could take my time finding jobs that were more flexible and better suited for a now-single parent. In the end, it turned out that I was incredibly lucky that my husband understood the importance of providing that safety net, even though he never thought we'd need to use it. Leslie and I couldn’t be more thankful.

Friday, December 22, 2017

Friday, November 17, 2017

Mr. Frosty

They have seen an Audit or Two

An Audit is done annually by an insurance company, usually before renewal to checks on the payroll or revenues of a business owner, to make sure the policy reflects accurate rating information.

Mr. Frosty business owner had $500,000 in sales and the policy premium is based on this. To save money the owner tells the insurance company sales are $250,000. During the audit the insurance company finds the business did half a million in sales. The Insurance company will adjust last year's policy cost and the balance amount is due. Some businesses will try to save money with a low estimated payroll or sales, but there's no way around it because insurance companies have seen this tactic once or twice before.

Defrosting

Meteorologist Ken Weathers defrosts a windshield with rubbing alcohol and water in a spray bottle.

Clearing frost from your windshield

Stalk Santa

Santa's Village

Thursday, October 19, 2017

Chicken or the Egg

What comes first Sales or Service

Always be Helping

If the goal of a company is only to make money, customers will know they are not a priority. When a company's priority is to provide a benefit by using their service, and helping customers understand the value, the result will be a positive sales experience and referrals.

Customer Experience

When Sales and Service are the driving force the overall result will always be a positive sales experience. Building relationships and becoming a resource by answering questions and nurturing customers make decisions through education will make customers feel good about not only making the purchase but becomes part of the overall customer experience.

Customer Service always and Sales always

Promise a lot and deliver more. In other words, exceed customer expectations.

Always Be helping🌷

Always Be helping🌷

Teresa

Thursday, October 5, 2017

11 weeks till Christmas

It's almost Christmas ...

Are you hiding your teen driver?

Coverage extends

In general coverage will extend if you lend you car to someone and they get into an accident. And most insurance companies extend coverage to accidents caused by teen drivers who were not listed on your policy. Companies know it's possible it "slipped" your mind to add your child to your policy.

Misrepresentation

Click to read full article

Rates

Discounts

Most Insurance companies offer discounts for driver's Ed and good grades. Some insurance companies offer safe driver programs for teens to watch videos and track trip logs to save money. And most companies won't charge you if your teen is away at school more than 100 miles from home.

Thursday, September 21, 2017

Smart Transportation

Stopping safely in an emergency situation

Sudden loss of power and the engine stalls -What do you do?

You're driving and suddenly there's no radio and no power. What should you do? Apply the brakes, soon steering will fail, next the brakes will go. Keep eyes on the road, try to steer to side of the road and put flashing hazard lights on.

Read Full Article

Don't panic

If you find it too difficult to slow down, move toward a safe area and use the emergency brake.

ABS Braking System

Vehicles equipped with an ABS braking system ought to provide controlled braking on most road surfaces. For ABS braking in an emergency situation:

* Press the brake pedal firmly.

* Don’t let up and allow the system to control wheel lock-up.

Another big VW recall

Carbuzz article

Thursday, September 7, 2017

Wheather the Storm

Mass Exodus

Thousands of cars headed North causing miles of backups on Florida's interstate Highways to flee the wrath of Hurricane Irma. Drivers waited for hours at gas stations, while others, including my daughter stood in line for hours at the airport. I'm so glad she's back safe in NY. My thoughts are with the people in FL, Carolinas and neighbor states - Be safe.

"Once the evacuation order is given, don't wait around," Sen. Bill Nelson

Hurricane Preparedness...Be ready

Weather.com

Wheather the Storm ... What you should know

You shouldn't wait to review your homeowners policy when there's a storm coming. Most insurance companies put binding restrictions in place before a storm preventing customers from purchasing policies or making changes like increasing coverage or reducing deductibles.

Homeowner policies usually cover damage from wind, rain and weight of ice and snow. Some policies have higher windstorm deductibles and most have higher Hurricane deductibles. Meaning your regular deductible will not apply if you have a loss during one of these storms. Review your policy and look for replacement cost and deductibles.

Most homeowner policies don't cover damage caused by rising water. So if a hurricane tears the roof off your home and rain damages your personal property the insurance would pay to repair the home and replace your possessions, but damage caused by water rising from a flooded street would only be covered by a separate flood policy.

Remember to play after the storm ~ Mattie Stepanek

Friday, September 1, 2017

Sorry...You're Exposed

What you need to know

If you own a buisnrss you're exposed to liability on a daily basis. Employer's Non Owned Liability provides liability insurance when your employees use their cars to run errands for your business. If your employees use their own cars for sales visits, trips to the hardware store or bank deposits for your business, you could be liable for any accidents they have.

What If

You send your employee to the hardware store to pick up a couple things you need to finish the job today. On the way to the store, your employee gets into a crash, rear ends another car. Are you exposed to liability?

The other car has damage and other driver goes to the hospital. Since your employee was driving for work, his/her personal auto insurance might not cover medical bills. But you have Employer's Non-Owned Liability coverage and your insurance will pay the other driver's medical bills up to the limits in your policy. Preventing you from getting sued.

Friday, August 25, 2017

Big data

How insurance companies decide your rate

Does low scores equal bad drivers?

There's different factors that determine your auto insurance rate, including your credit rating, age, gender, marital status, driving record and address. Also statistics about your neighborhood and traffic counts in your area.

Crystal Ball

Insurance companies look at your credit and other data to predict if you're more likely to be a risk, have crashes and file claims.

Type of car, deductible and coverage

It's difficult to compare rates, people have different driving records and different cars. The best way to compare policies is to look at the deductibles and coverage.

Ways to keep cost down

High vehicle safety ratings

Discounts

Drive less

The value of an agent

Talking to an agent about coverage and discounts can save you money.

Thursday, August 17, 2017

Under my Umbrella Ella ella

Could Save You Millions

Now that it's raining more than ever

Umbrella protects all your assets. It pays your legal fees if you're sued. And the couple of hundred dollars for annual premium is about the same as an hour's consultation with a lawyer. It provides an additional layer of protection. 1M, 2M, 5M or more above the liability limits of your auto and Homeowners Insurance. With an Umbrella policy you'll have a team of attorneys working on behalf of your insurance co protecting your assets.

Umbrella

What ifs...

"HERE’S the nightmare: Your car skids. You crash into a Mercedes with a highly paid business executive at the wheel. He’s hurt so badly he cannot return to work. A jury awards him millions of dollars and you have to pay it."

New York Times article

“After attending a Christmas party, my client got involved in a fatal auto accident where the other driver was killed… My client was given a breathalyzer on the scene and exceeded the legal alcohol limit. He was sued for something like $1.25 million by the claimant’s family and was legally liable for the damages, which were paid by the umbrella policy. The client was otherwise an upstanding citizen with no past history of these kinds of events.”

Thursday, August 3, 2017

I.O.U. and sometimes Y

Actually... O.E.M.

OEM VS Generic Crash Parts

Does your insurance co pay for OEM parts?

Replacement crash parts like fenders, hoods and doors panels provided by the manufacturer are called original equipment manufacturer (OEM) parts. Parts that are made by generic companies or aftermarket crash parts are usually at a lower cost.

Ranking

|

| Source: S&P Global Market Intelligence |

[hugs]

Teresa

Thursday, July 27, 2017

Friday, July 21, 2017

Cutting off your nose

Cut off your nose to spite your face

I get calls almost everyday from people looking for ways to save money on their insurance. Some of these callers are regulars, calling every few months - Most of them refuse to take the Defensive Driving Course.

Rental Reimbursement

You should never remove rental. Especially if you only have 1 car. This coverage pays for a rental car. If you're in an accident and the car ends up in the shop for repairs, you'll need a car to get around. This coverage provides you with a car rental while the car's being repaired.

Remove Emergency Road Side Service, I have AAA

ERS coverage costs only a few dollars. Even if you have AAA or towing through the dealership, you should have ERS on your auto policy. If you break down in a remote area, it's good to have a back up.

Lower my limits...State requirements are only 25/50/10

10 is 10,000 and it pays for repairs to the car you just accidentally rear ended. If that car costs more than 10K to repair (probably), or if it was pushed into another car in front, causing a multi-car pile up, you will not have enough coverage. So you've just compromised your coverage. Trying to save a few dollars can expose your home and assets. For a savings of maybe $5.00.

Other ways to save

Maybe choose the $200 Deductible on your Personal Injury Protection coverage. This coverage pays at least $50K of your Medical bills in the event of an accident. If you or household relatives go to the hospital, choosing the $200 Hospital deductible saves you a little bit of money.

Discounts

Here's the link to the course

New York Defensive Driving Course

If you have young drivers in the house, and they maintain a 3.0 GPA or B average, get the Good Student Discount just by getting a printout of their school transcript.

[hugs]

Teresa

Friday, July 14, 2017

Bubble Wrap

Moving

The day of the move

Moving can be an emotional time. Next time you move think about purchasing a one time trip transit Inland Marine policy- One less thing to worry about. And it can save thousands of dollars, protecting your belongings while in transit with the moving company.

Busiest day in the moving industry is July 31st

Americans on the Move

Top 5 Most moved-to states:

1. Florida

2. Texas

3. Washington

4. North Carolina

5. Colorado

Top 5 Most moved-from states:

1. New York

2. Illinois

3. New Jersey

4. Massachusetts

5. Pennsylvania

1. Florida

2. Texas

3. Washington

4. North Carolina

5. Colorado

Top 5 Most moved-from states:

1. New York

2. Illinois

3. New Jersey

4. Massachusetts

5. Pennsylvania

Bubble Wrap

Is $5.6 billion industry, according to the Freedonia Group. That’s right—$5.6 billion.Thursday, July 6, 2017

Back to the future

A big day for Tesla

Tesla's first "affordable", pure-electric car is off the assembly line today. Delivery of the 370,000 Models 3 ordered in advance will start at the end of the month.

Creating the future

Uncertainty about the future it helped create. Read full article Here

If you build the industry will follow

Volvo announced this week that by 2019 it will use only electric or hybrid motors in its vehicles.

"What Tesla has done is quite remarkable, and it has forced other automakers to get into the game," said Michelle Krebs, executive analyst at Autotrade.

Welcome to the future

[hugs]

Teresa

Thursday, June 22, 2017

All Dogs Matter

Have Pitbull, need Homeowners

Insurance companies shouldn't exclude insuring people based on the breed of their dogs. "All Dog breeds deserve a chance."click here to read full arti

Summer is here

Rescue a Dog from a hot car

Most people know leaving children alone in cars during hot days can cause heat stroke or even death. But what would you do if you saw a puppy in that situation?

It's illegal in 16 states to leave a dog alone in a car in extreme heat. NY and NJ are two of these states.

New York: NY Agri. & Mkts. § 353-d

“A companion animal [cannot be] confined in motor vehicle in extreme heat or cold without proper ventilation or other protection where confinement places companion animal in imminent danger of death or serious injury due to exposure.”

What to do if you see a dog in a locked car

70 degrees outside = 90 degrees in a car with closed windows after 10 minutes.

And 30 minutes at 70 degrees = 104 degrees.

Take a picture of the car showing the dog inside the car, including the license plate, screenshot a picture of the current weather in your area and call the police before taking the matter into your own hands. You might put yourself at risk of fines or criminal charges breaking the window. Use your judgement - "While Good Samaritan laws do not exist in many states, according to attorney and Director of Legal Affairs for the Animal Protection League of NJ Doris Lin, the chances of being prosecuted for saving an animal from a hot car are rare."

Thursday, June 15, 2017

A Good Deed

Helping our Veterans...Paying It forward

Imagine just one day that everybody in the world would "pay it forward". One at a time we would change the world. Today State Farm helped an Army Veteran by donating a set of wheels. Thanks to the help of charitable organizations and State Farm, an Army Vet, single mother of 3 and brain tumor survivor was surprised with a 2007 Toyota Camry at Stephanie Sgroi's office in Port Jeff Station.

"It's a small effort for our company to pay back veterans for their service and the risk they took,"

said Steve Wisotsky, of State Farm Insurance.

Just one of the ways State Farm helps LIFE go right

|

| Michael's Auto Collision donated repairs |

Helping Horses

The Warrior Ranch Foundation

9-1-1 Veterans

Is a organization dedicated to helping LI Veterans911 Veterans

Friday, June 9, 2017

Thursday, June 1, 2017

Care Bears

Are you too young to care about Life Insurance

Thursday, May 25, 2017

My Dog ate my Homework

Teacher my dog ate my homework

I'm a big believer in insurance. Especially when it comes to LIFE Insurance. I love talking about it, explaining it, learning about it and selling it!

If you like it you better put a ring on it...

Being in the industry, I know jewelry should be insured on a separate policy. I don't have lots of Jewelry, but every piece has a special meaning. I've been married 23 years...Many memories. Some great, others so so. Every piece reminds of the occasion and the life we've built.

Just another Blog

If I haven't bored you, and you're still reading, it may seem like just another blog, but keep reading, it gets a little better. Tuesday morning I went to 711 before work, got a cup of crumbcake coffee. Yummy! This was a special treat. I usually drink Keurig at the office. After a long day at work, on my way home I stopped at Meat Farms for a quick food shopping. Get the picture... a normal day. When I got home, I glanced at my hand and my Diamond Anniversary band was gone. In a fraction of a second, I was filled with an overwhelming sense of loss, panic and despair. You'll never understand the felling until you've experienced it. I looked for my ring for hours, I drove back to Meat Farms, I called 711. I tried thinking back to where I could have lost it, retraced my steps. And cried. I knew in my heart the ring was gone. Still, the next day, I looked in the parking lot at work, in the office, through my trash. In the recycling bin. I just knew it was gone. Thankfully for me, this story has a happy ending. This morning, while I was packing my lunch for work, my dog Meeko was playing with the ring on the floor. I don't know how I lost it, and I don't know how my dog got a hold of it. It's a miracle. I can't wrap my head around it. I'm just happy to have it back.

I told you so

The moral of this story is I should have insured the ring on a separate policy. Yes jewelry is covered under my Homeowners policy. But there's limitations, and I have a $3000 deductible. I'm in the industry, I know this. Anyway, I would never have filed a Homeowners claim for lost Jewelry. Yet I never got a Personal Articles Policy. It's separate protection just for your valuables. With a low or no deductible. An affordable peace of mind to have coverage on your valuables. Depending on how much Jewelry you have, it's probably about $100 for the year.

Teacher I learned my lesson

I made an appointment to have my jewlery appraised and I'm writing my own Personal Articles Policy. I know it's easy. I just need to show the appraisal and pictures. I'll have insurance and peace of mind. I never want to have that helpless, sad sense of loss. And I'm telling this story to every customer that buys Homeowners Insurance. A simple, inexpensive way to insure your jewlery.

[Hugs]

Teresa

Thursday, May 18, 2017

Bob the Builder

I'm always careful

If you're entering someone's house or place of business you're putting yourself at risk simply by being there. A small job can cause thousands of dollars worth of damage. Among other things, Liability insurance takes care of legal fees. Protecting you from a loss that could put you out of business.

Types of business insurance

Property insurance - covers your building, equipment or inventory.

General liability insurance / Business Owners policy - pays for your defense if your service causes damage or harm. It can also cover medical bills to others.

Workers compensation - is required in NY if you have employees. It provides coverage for employees who are injured on the job.

Commercial auto insurance - depending on type of vehicle and if driven for business use.

Commercial Insurance Premiums Up in April

Teresa

Thursday, April 27, 2017

The C Word

Fight the C word One Step at a Time

Beast cancer is caused by cells in the breast that become abnormal and multiply forming a tumor. 1 in 8 American women will develop Breast Cancer. While we can't walk in their shoes we can help fight Cancer one step at a time.

Spread the word about Mammograms

Find a cure

Families Walk and Run for Hope.

Saturday May 6th.

Support Stephanie's Bosom buddies. Walk and Run or click below to donate.

Stephanie's Bosom Buddies

All money raised goes to the Fortunato Breast Health Center at Mather Hospital. "Together we are educating our community about breast cancer one step at a time"

FU Breast Cancer

[Hugs]

Teresa

Thursday, April 20, 2017

R2D2

Robots Vs Humans

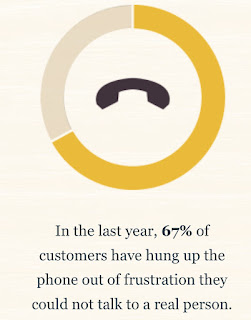

You think it's frustrating talking to a person in a call center? If you're insured with GEICO or Allstate, within 3 years you'll probably be talking to a robot. These companies have invested in Artificial Intelligence. Google and Amazon are helping spread the word about virtual assistance and this technology is reshaping how some companies do business. Soon when you call to make payments or ask coverage questions you might find yourself talking to R2D2.

Insurance Journal

click here

Smart Home

See article Click here

Smart Cars

Who pays for damages when a self driving car is in an accident?

Probably the manufacturer🤷🏻♀️ See article click here

Probably the manufacturer🤷🏻♀️ See article click here

[Hugs]

Teresa

Thursday, April 13, 2017

Every Bunny needs Insurance

Claim Happy

You probably don't want to hear this but the truth is, if you don't want to pay more for insurance, don't be claim happy. If the price to repair is close to your deductible, don't file a claim. Having no accidents/claims for 3 years gets you a better rate - insurance companies like low risk drivers. [sorry]

Property Damage

If you are rearended, the other driver is at fault, file what is called a "Property Damage" claim directly with the other driver's insurance company to repair your car. This way you don't have to lay out a out of pocket deductible.

On-line Defensive Driving Courses

Taking the Defensive Driving course saves 10% on insurance for 3 years. On-line 6 hour courses are usually more affordable and you can take up to 30 days to finish. Here's a link to NY approved Defensive Driving Course providers.

Multi-Line

If you bundle all your insurance with the same company you get Multi-Line discounts saving you up to 25% [nice].

Every Bunny needs Insurance...Happy Easter💕

[hugs]

Teresa

Thursday, April 6, 2017

U Drive. U Text. U Pay.

April is Distracted Driver Awareness Month

On Any Given Day

82% of 17 yr olds own a cell phone and 34% of those say they've texted while driving.

Sending texts, taking your eyes off the road for just 5 seconds, at 55 mph, that's like driving the length of a football field with your eyes closed.On any given day over half a million drivers are using cell phones while driving. [scary]

Teen drivers are the largest age group reported as distracted at the time of fatal crashes.

Safety Awareness

Protect lives by never texting while driving. Speak out if the driver is distracted and encourage friends and family to just drive. Help protect lives by taking the pledge to end texting while driving.

Take the pledge #Just Drive

I pledge to Just Drive for my own safety and for others with whom I share the roads. I choose to not drive distracted in any way – Click on link below to take the pledge.

Distracted Driver Pledge

Distracted - not just Texting

[hugs]

Teresa

Thursday, March 30, 2017

Obamacare ... I care

Hospital indemnity ... not Health Insurance but makes it better

It pays a set amount per day or per visit – if you're confined to a hospital bed or visit the ER. Health Insurance pays for medical services. Hospital Indemnity pays you. It helps pay copays and pays you for emergency room visits or unexpected Injuries.

Affordable Care Act - Will the number of choices drop?

Ever got paid for just laying in bed?

It's not Health Insurance but makes it better

It's supplemental and the cost is usually under $20 per month ... totally worth it.

A 3 day stay in the Hospital pays you $720.00. Not bad for just laying in bed.

Teresa

Friday, March 24, 2017

Rainy Day

Childcare is more expensive than in state college tuition

If your spouse is at home raising the children and you're the breadwinner think about having Term Life insurance in place during the children's formative years. The cost of childcare would cause a huge financial strain on the working parent if the stay at home spouse died. Life would drastically change if the surviving working parent needed live-in childcare.

Life Events

Life doesn't stand still. Your life is probably not the same now as it was 5 years ago. People get married, have babies, or get divorced and remarry, becoming blended families. It's a good idea to re-evaluate Life Insurance policies every year to make sure beneficiaries are up to date. Also consider increasing coverage if the family grew.

Better shape and / or losing weight and quitting smoking can qualify for a better rate. If you didn't qualify or were quoted a higher rate because of health problem, look into a rate reconsideration. This might reduce your premium, which saves you money or lets you increase coverage for the the same price - Nice!

Better Rate

[hugs]

Teresa

Wednesday, March 8, 2017

King of the Road

No LIFE Insurance... N

76 annual Daytona Bike week -Taking place now through March 19.

SUM is your best friend

UM and SUM coverage should match your Bodily Injury. SUM will pay your medical bills if someone hits you while Uninsured or Underinsured . Picture getting into an accident with a driver who lapsed their insurance because they were late on a payment. SUM can be your best friend.

Spring Forward, Fall Back

Spring is around the bend [pun]. If you plan on putting your motorcycle on the road, you should buy LIFE insurance now and guarantee your insurability while you're healthy to lock into the best possible rate.

Somebody's got to talk about it

25 Times

Stats

4,693 motorcycle crashes were fatal in 2015 and 60% occured in the Spring.Florida leads nation in Motorcycle fatalities. Only 47% of riders wear helmets.

Last but not least, who didn't binge watch Sons ... on Netflix?

[Hugs]

Teresa

Thursday, March 2, 2017

Ain't got no ... And are we selfish

Unless you've been living under a rock you've heard about GOFUNDME accounts. From raising money for a single mom in the community, to helping pay for a cute kitten's rare surgery. I feel especially heartbroken when I hear about a child sick with the "C" word or a family who lost everything when a parent died.

Did you know it's a business

GOFUNDME charges for using their platform. They deduct 5% from each donation plus a processing fee of 3% from each donation.Getting out of control

There's approximately 8M requests daily on GOFUNDME for unexpected and tragic losses. So many that some people aren't able to raise any money.

Sooner rather than Later

Life Insurance allows your family to carry on financially if you die. Life doesn't stand still and an unexpected death brings unexpected expenses. Usually families aren't prepared for it emotionally or financially. Plan ahead and guarantee your insurability now before it's too late.Term Vs Whole

Term Life policies typically give you more coverage at a more affordable premium.

Whole Life policies are long term policies. The major pro is that you lock into the age you are when you buy and have coverage up to the age of 100...your hole life!

Whole Life insurance lets you protect your assets and build cash value that you can use later in life by borrowing against it. If you have an unexpected expense, you won't need to depend on charity of others from a GOFUNDME you can just borrow against your Whole Life policy.

Are we selfish

30% of Millennials think saving for a vacation is more important than buying Life Insurance. Sadly that's a lot of future GOFUNDME accounts.

You think you can't afford it...then you definitely need it today.

If you can't afford to pay a bill that typically costs between $25 and $50 per month, how is your family going to pay all of the other expenses like housing, food and gas if you die?

[hugs]

Teresa

Thursday, February 23, 2017

Shopping around

Customers shop around but they spend money when they see value.

I used to work for a company that was known as a low cost provider. This sounds awesome until the customer has to make a phone call or file a claim. Picture this, the people that worked there had insurance with State Farm.The Call Center

Speaking to a Rep. in a call center? if you need to call back, not only do you get a different representative on the line, but also possibly another call center out of state.

Remarkable service has big value

This Wednesday was an example of our standards for remarkable service. The customer received a suspension letter from DMV, although it was an error, it could still have caused him a headache. Imagine being pulled over by the police..."Officer, that's an error, I really do have insurance."... I don't think a cop will buy that. But this is when Laura, our office Mgr. saved the day. Not just by calling the DMV industry hotline in Albany, but by calling our local DMV in Port Jeff Sta.! And a real live person answered! and she was helpful! She checked the insured's registration and said the suspension was reversed. Peace of mind and very cool if you're into Insurance.

Shopping around, consider staying when you see the value in Remarkable Service.

Teresa

Thursday, February 16, 2017

Insurance Friday...Dear Mom

Dear Mom, I Wish You’d Had Life Insurance

Brittney LaCombe's real life story.

I live in St. Petersburg, Florida. On May 8th, 2011, my mother, two younger sisters and I drove to a local campsite for our annual Mother’s Day camping trip. When we arrived, my mother said that her foot was bothering her. We thought maybe she had hit it on something, so we didn’t think much of it. But that night, the pain got so bad she couldn’t stand it. She called 911 and an ambulance took her to a hospital. At 6:30 the next morning I got a call from the hospital. When they had gone to check on her that morning, she was blue. She had died from a pulmonary embolism—a catastrophe that left me without a mom. Suddenly, at 20 years old, I was the head of the family, and I had to take care of my sisters, who were 15 and 16, on my own. My aunt came over the next day to help me deal with funeral arrangements. I wanted to bury my mother, like she wished. But when we finished looking through all of her bank accounts and papers, we realized she only had $300 in the bank. I knew that our finances weren’t great, but I didn’t think we could be that bad off. A funeral costs thousands, out of the question. I hated the idea of cremation, but that’s the only thing the state would pay for. We couldn’t even afford to hold a reception, and all of my mother’s family members never got the opportunity to gather and grieve together. I felt devastated—I didn’t know where to go or what to do. Within a week of her passing, shut-off notices came for the electricity and water. The bank called every day looking for a payment on the mortgage. Since I was only working part time, paying these debts was out of the question. Even though I explained my situation to the bank, I was told I only had weeks before the house would be foreclosed on and our electricity and water would be cut off. We also had to give our pets away. Our two dogs went to family members until we could afford to get them back. Our cats went to the shelter...

Brittney LaCombe's real life story.

I live in St. Petersburg, Florida. On May 8th, 2011, my mother, two younger sisters and I drove to a local campsite for our annual Mother’s Day camping trip. When we arrived, my mother said that her foot was bothering her. We thought maybe she had hit it on something, so we didn’t think much of it. But that night, the pain got so bad she couldn’t stand it. She called 911 and an ambulance took her to a hospital. At 6:30 the next morning I got a call from the hospital. When they had gone to check on her that morning, she was blue. She had died from a pulmonary embolism—a catastrophe that left me without a mom. Suddenly, at 20 years old, I was the head of the family, and I had to take care of my sisters, who were 15 and 16, on my own. My aunt came over the next day to help me deal with funeral arrangements. I wanted to bury my mother, like she wished. But when we finished looking through all of her bank accounts and papers, we realized she only had $300 in the bank. I knew that our finances weren’t great, but I didn’t think we could be that bad off. A funeral costs thousands, out of the question. I hated the idea of cremation, but that’s the only thing the state would pay for. We couldn’t even afford to hold a reception, and all of my mother’s family members never got the opportunity to gather and grieve together. I felt devastated—I didn’t know where to go or what to do. Within a week of her passing, shut-off notices came for the electricity and water. The bank called every day looking for a payment on the mortgage. Since I was only working part time, paying these debts was out of the question. Even though I explained my situation to the bank, I was told I only had weeks before the house would be foreclosed on and our electricity and water would be cut off. We also had to give our pets away. Our two dogs went to family members until we could afford to get them back. Our cats went to the shelter...

Reality

I don't want to be the one that tells your family you didn't have Life Insurance.Get Life Insurance

With just a little planning you can get coverage with a policy that fits your budget.The right Insurance Co.

You make a promise to your loved ones, make sure it's with a company that will be there for them when needed.

Teresa

Teresa

Subscribe to:

Comments (Atom)